Japan economy grows for 2nd straight quarter on back of consumer spending

Japan’s economy eked out an annual rate of 0.9% growth in the July-September period as consumer spending held up, government data showed Friday.

The world’s fourth-largest economy grew 0.2% in the fiscal second quarter, marking the second straight quarter of expansion, following 0.5% growth in April-June.

Seasonally adjusted gross domestic product, or GDP, measures the value of a nation’s products and services. The annual rate shows how much the economy would have grown or contracted, if the quarterly rate continued for a year.

Domestic demand grew at an annualized rate of 2.5%. Private consumption, which makes up more than half of Japan’s GDP, grew 3.6% on the back of healthy household consumption, according to preliminary Cabinet Office data.

Recent data show wages and employment are improving. Spending was lower than the previous quarter, partly because of severe weather that crimped spending and shut down some factories. Recent income tax reductions helped boost spending.

Exports grew 1.5%. The weakening yen is a plus for exports, tending to make Japanese products cheaper overseas. But the impact was relatively limited in the latest quarter. The Japanese yen was trading at 160-yen levels earlier this year. It’s now trading at 150-yen levels.

Prior to the last two quarters, the economy contracted 0.6% in the January-March quarter after recording a 0.1% growth in October-December in 2023, highlighting how Japan’s economy recently slipped into periods of contraction in between weak expansion.

“We believe the Japanese economy will continue to grow gradually, supported by growth in overseas economies,” said Katsutoshi Inadome, senior strategist at SuMi Trust.

He noted winter bonuses many Japanese get in coming months should also help strengthen domestic demand.

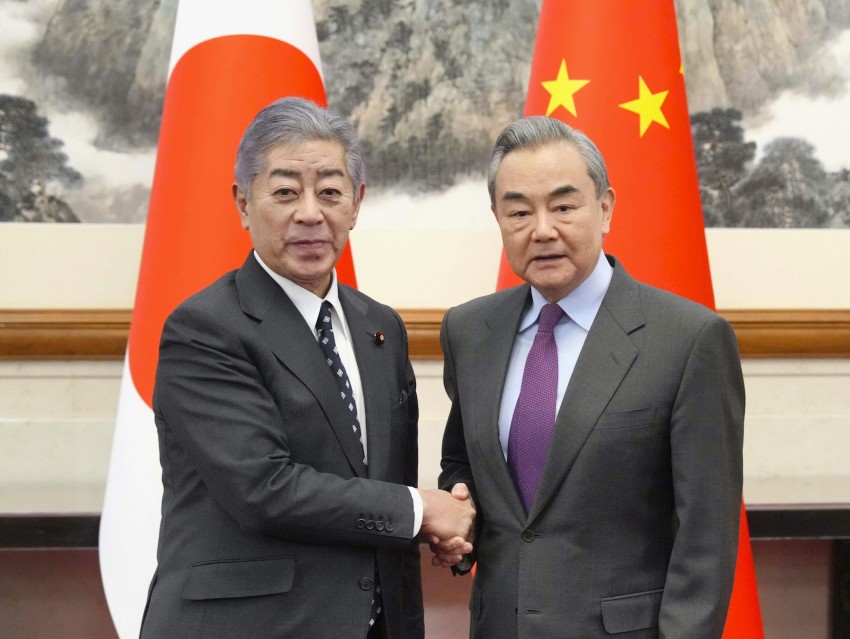

As for headwinds, Japan is facing political uncertainty with Prime Minister Shigeru Ishiba having to survive a runoff this week to remain in office but now facing an emboldened opposition.

Unlike the U.S. and other developed nations grappling with inflationary pressures, Japan struggled with years of deflation, or a continuous cascading down of prices that underlines a fragile economy. Inflation stood at 2.5% in September.

Market watchers are also focused on when the central bank might move next on interest rates. The Bank of Japan kept interest rates at zero or below zero for years to wrest the economy out of deflation but is gradually raising them.