Japan rejects Trump claim it is pursuing yen-weakening policy

Japan on Tuesday rejected U.S. President Donald Trump's claim that Tokyo is pursuing a policy to devalue the yen, adding that it will maintain close communication with Washington on foreign exchange matters.

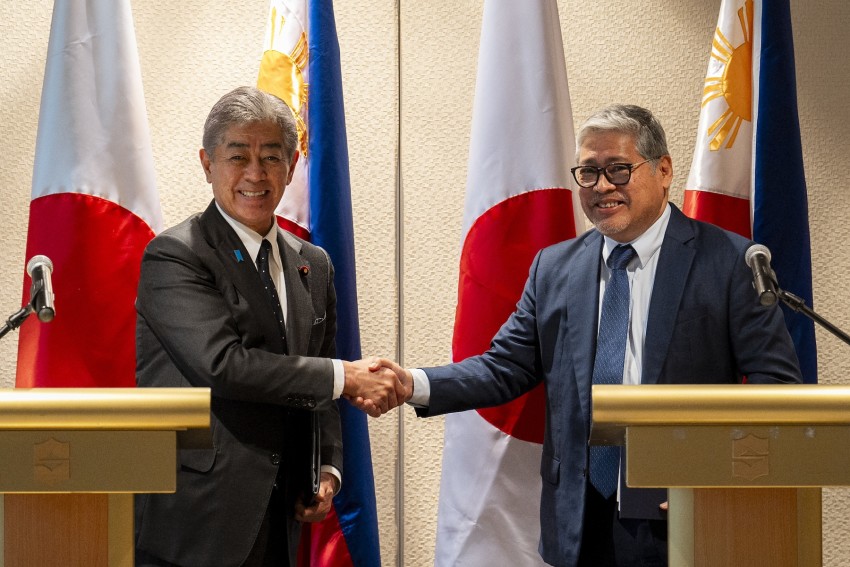

"We are not adopting a policy to weaken the (Japanese) currency. If you recall our foreign exchange market interventions in recent years, you can understand what I mean," Finance Minister Katsunobu Kato said at a press conference.

On Tuesday in Tokyo, the yen jumped against the U.S. dollar after Trump said he had notified the leaders of Japan and China that they cannot continue to "reduce or break down" the value of their currencies.

Trump told reporters that Japan and China "can't do it because it's unfair to us," adding, "It's very hard for us to make tractors, Caterpillar here, when Japan, China and other places are killing their currency, meaning driving it down."

Japan's Chief Cabinet Secretary Yoshimasa Hayashi, the top government spokesman, said at a separate news conference, "Currency issues will remain under close discussion" between Kato and U.S. Treasury Secretary Scott Bessent.

The Bank of Japan kept its monetary policy ultraloose for over a decade to achieve its inflation target, pushing down the yen against other currencies. The yen's depreciation has also helped the performance of the country's exporters and boosted inbound tourism.

In the past few years, however, Japan repeatedly stepped into the market to slow the currency's rapid decline against the dollar in a bid to curb the negative impact of the lower yen -- a reflection of the policy divergence between the BOJ and the U.S. Federal Reserve.

Since Kazuo Ueda became the BOJ governor in 2023, Japan's central bank has entered a rate hike cycle, but the yen has remained on a downward trend against the dollar.